Management fees earned from Separate accounts increased 39% to $107.3 million.

Management fees earned from the Artisan Funds & Artisan Global Funds were up 44% year over year to $176.7 million. Also, the top line surpassed the Zacks Consensus Estimate of $266 million. The rise primarily resulted from higher average AUM balance. Revenues came in at $290.7 million, up 43% from the year-ago quarter. Net income available to common stockholders (GAAP basis) was $77.3 million or $1.19 per share, up from $34.8 million or 53 cents per share in the prior-year quarter. However, higher expenses posed an undermining factor. Also, higher assets under management (AUM) on net inflows acted as a tailwind. Results were supported by rise in revenues. Also, the bottom line was 71% higher than the year-ago quarter figure. Investor Relations Inquiries: 866.632.1770 or Artisan Partners Asset Management Inc.Artisan Partners Asset Management APAM first-quarter 2021 adjusted earnings came in at $1.13 per share, surpassing the Zacks Consensus Estimate of $1.10. Strategies are offered through various investment vehicles to accommodate a broad range of client mandates. Artisan Partners' autonomous investment teams oversee a diverse range of investment strategies across multiple asset classes. Since 1994, the firm has been committed to attracting experienced, disciplined investment professionals to manage client assets.

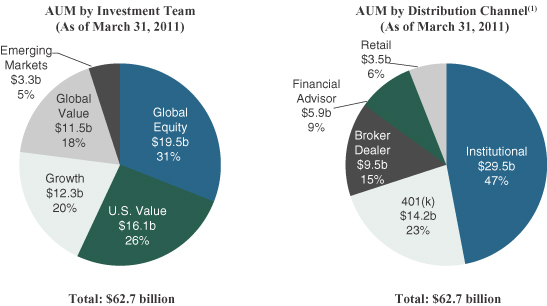

ARTISAN PARTNERS AUM UPDATE

Our periodic and current reports are accessible on the SEC's website at The Company undertakes no obligation to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this release.Īrtisan Partners is a global investment management firm that provides a broad range of high value-added investment strategies to sophisticated clients around the world. These factors include: the loss of key investment professionals or senior management, adverse market or economic conditions, poor performance of our investment strategies, change in the legislative and regulatory environment in which we operate, operational or technical errors or other damage to our reputation, and other factors disclosed in the Company’s filings with the Securities and Exchange Commission, including those factors listed under the caption entitled “Risk Factors” in Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on February 22, 2022, as such factors may be updated from time to time.

These forward-looking statements are subject to a number of risks and uncertainties, and there are important factors that could cause actual level of activity, actions or achievements to differ materially from the level of activity, actions or achievements expressed or implied by the forward-looking statements. Forward-looking statements are only predictions based on current expectations and projections about future events. Statements regarding future events, as well as management’s current expectations, beliefs, plans, estimates or projections relating to the future, are forward-looking statements within the meaning of these laws. Separate account and other AUM includes assets we manage in traditional separate accounts, as well as assets we manage in Artisan-branded collective investment trusts, and in our own private funds.Ģ AUM for certain strategies include the following amounts for which Artisan Partners provides investment models to managed account sponsors (reported on a one-month lag): Artisan Sustainable Emerging Markets $80 million.Ĭertain statements in this release are “forward-looking statements” within the meaning of the federal securities laws. Total Firm Assets Under Management ("AUM")ġ Separate account and other AUM consists of the assets we manage in or through vehicles other than Artisan Funds or Artisan Global Funds. PRELIMINARY ASSETS UNDER MANAGEMENT BY STRATEGY 2

0 kommentar(er)

0 kommentar(er)